Michael Vi

How quickly things change in the world of investing? It wasn't long ago that Palantir Technologies Inc.'s (NYSE:PLTR) stock was down in the dumps and desperately needed supporters. I am glad that I called it a diamond in the rough in April, and the stock has since gone up 80%, backed by strong Q1 earnings. So, clearly, the stock has many more supporters now. However, there are still enough signs that show no one has a clue where the stock is headed next. Let's look at a couple of exhibits that prove this.

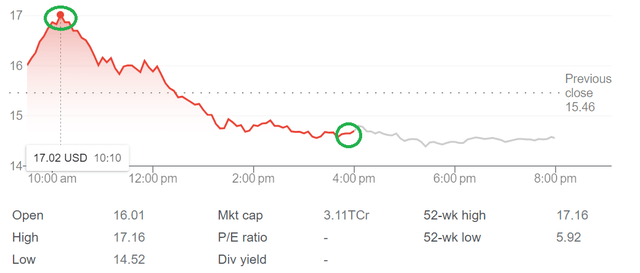

Exhibit #1: The stock had a nearly 20% swing between its day's high and day's low yesterday, as shown below. With all the excitement around AI, it is easy to forget that Palantir is a thirty billion dollar company that "shouldn't" have wild swings like this. The word that comes to my mind is "frenzy", which is defined by Webster as "emotional agitation".

PLTR Stock (Google Finance)

Exhibit #2: Generally speaking, analysts are reluctant to slap a sell rating on a momentum stock. There is also a natural reluctance to call a stock a "Strong Buy" after a near 100% run. However, SA analysts have pretty much done both in the last 3 days with Palantir stock as seen here. Once again, emotional agitation is playing a role.

What's An Investor To Do?

Will the stock keep going up or will there be a violent sell-off? Again, no one knows for sure. The stock has risen 130% YTD as of this writing, while it was up nearly 170% at yesterday's high of $17.16. If you don't have any position in the stock at this point, the most prudent thing to do is wait for things to cool off a bit.

However, if you hold the stock and are sitting on big gains, the situation gets trickier. Selling a momentum stock early is something many of us have regretted. Is there a middle ground? Sure there is, and that is the point of this article.

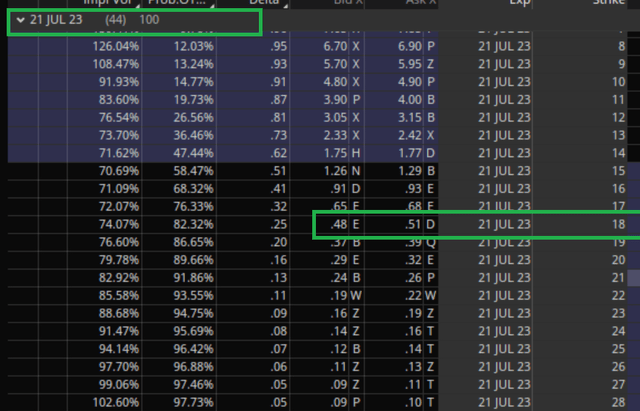

Enter Covered Calls

If you hold at least 100 shares of Palantir, Covered Calls allow you to collect premiums for agreeing to sell your shares at a price you pick. While that sounds too good to be true, it indeed is true, as explained below. The options chain I am recommending is the $18 strike price expiring on July 21st, 2023

PLTR Chain (Think or Swim)

Key Data Points of This Trade

- The call seller gets about $50 per contract (100 shares) for agreeing to sell Palantir stock at $18 should it reach that price or beyond by the expiration date, July 21st, 2023.

- Returns if Palantir goes above $18 by Expiration: You will be called away, meaning forced to sell your Palantir shares at $18. The number of shares you need to sell depends on the number of contracts (of 100 shares each) you sold as part of the sample transaction above. Based on the current price of $14.69, the strike price of $18 represents 22.50% upside from here. Including the premium of 50 cents per share, the total returns in this scenario is nearly 26% in less than 2 months. Not too bad. Bear in mind that Palantir reached $17.16 yesterday, and reaching $18 may not be much of a stretch given that the options chain expires a month and a half from now. If this strike price and/or the expiration date appear too close for your liking, please adjust accordingly.

- Returns if Palantir stays below $18 by Expiration: You just added a cool 3.50% to your Palantir returns for agreeing to sell at a higher price. And you retain all your shares.

Why I Believe This Is A Good Trade?

- Technical Reason #1: There is a high probability (82%) that Palantir stock will be below $18 by the expiration date and if you believe in the stock's long-term potential, this works in your favor as you are unlikely to get called-away (aka forced to sell your shares in lots of 100 each).

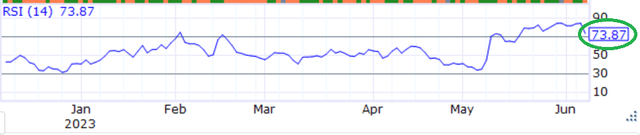

- Technical Reason #2: Palantir stock has momentum in its favor, despite the turbulent 20% swing yesterday. The stock's Relative Strength Index ("RSI") is at a healthy 73 as of yesterday's close. While this is slightly above the textbook definition of overbought condition (>70), this shows buying strength while leaving enough room for the stock to run a bit further. Hence, it is prudent to stay and collect additional premium instead of selling the stock outright.

PLTR RSI (profitspi.com)

- Technical Reason #3: Palantir stock is currently trading way above the commonly used moving averages. Once again, this suggests a stock with strong upward momentum, and selling your shares outright here may cap off your gains.

- Options are generally considered more volatile than stocks. And Palantir is not your average stock when it comes to volatility. Add these two factors to an upcoming earnings report, and things can get too hot, too quickly. Hence, I am picking an options chain that expires a good two weeks before Palantir's next earnings report expected on August 8th, 2023.

Fundamental Considerations

None of the technical indicators and options chain matter if the underlying company is broken. Palantir, the company, is far from broken, although the stock may be running on fumes right now. I've always liked Palantir's positioning in the big data analytics and its strong foothold in the Government space. The company surprised investors in the last two quarters with profit, propelled by AI demand in the most recent report, and the stock rallied (deservedly I'd say).

However, should Palantir reach $18 (the strike price used in the option chain) and stay there, we are talking about a $40 billion company trading at 20 times trailing twelve months' revenue. In addition, even though the company surprised investors with the promise of being profitable every single quarter in 2023, even if the company meets 2023's EPS estimate of 21 cents per share, at $18, the stock's PE will be a monstrous 85. These numbers remind me of the company's valuation in 2021 before things came crashing down. Using Covered Calls in such situations makes sense as the stock's momentum is likely to continue in the short-term but at some point, the overvaluation will catch up and result in a significant sell-off in my view.

Conclusion

As I mentioned above, you may not be a fan of this particular trade (strike price, expiration date, or premium) but the larger point is to take advantage of relatively "safe" strategies like Covered Calls to enhance your returns. Options trading can be used in conjunction with fundamental and technical analysis, as presented in this article. The easiest and most tempting thing to do when a stock goes on a huge run is to sell outright. There is nothing wrong in taking profits but taking profits too early is something I've been guilty of many times.

"Exit" - Google News

June 09, 2023 at 01:17AM

https://ift.tt/mbOh1ZI

Palantir: A Better Way To Exit Than Selling Outright (PLTR) - Seeking Alpha

"Exit" - Google News

https://ift.tt/wMc9sK0

https://ift.tt/y3T2k75

Bagikan Berita Ini

0 Response to "Palantir: A Better Way To Exit Than Selling Outright (PLTR) - Seeking Alpha"

Post a Comment