panggilansaja.blogspot.com

Adblock test (Why?)

"Exit" - Google News

November 04, 2022 at 06:14PM

https://ift.tt/H1iOSw8

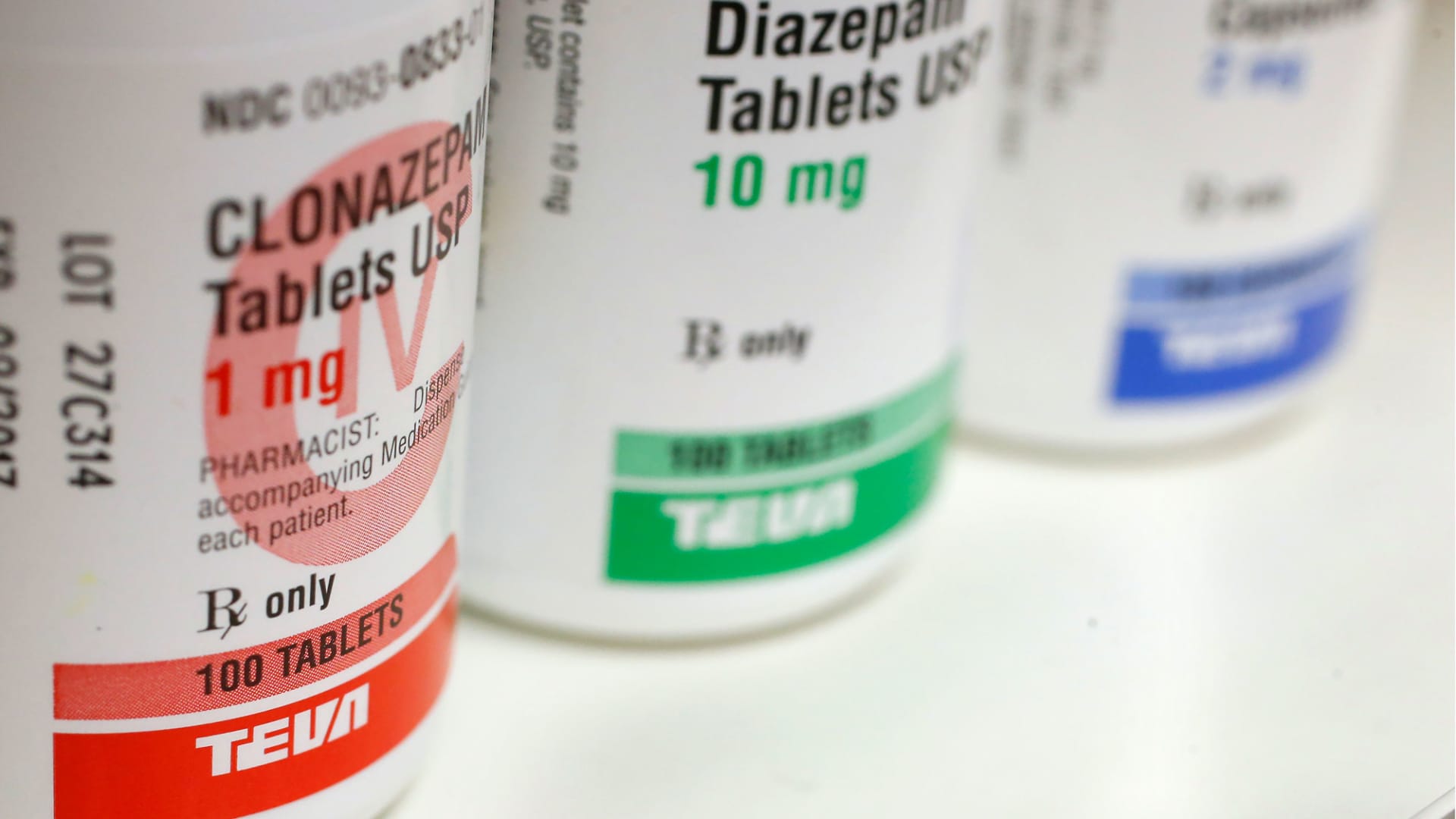

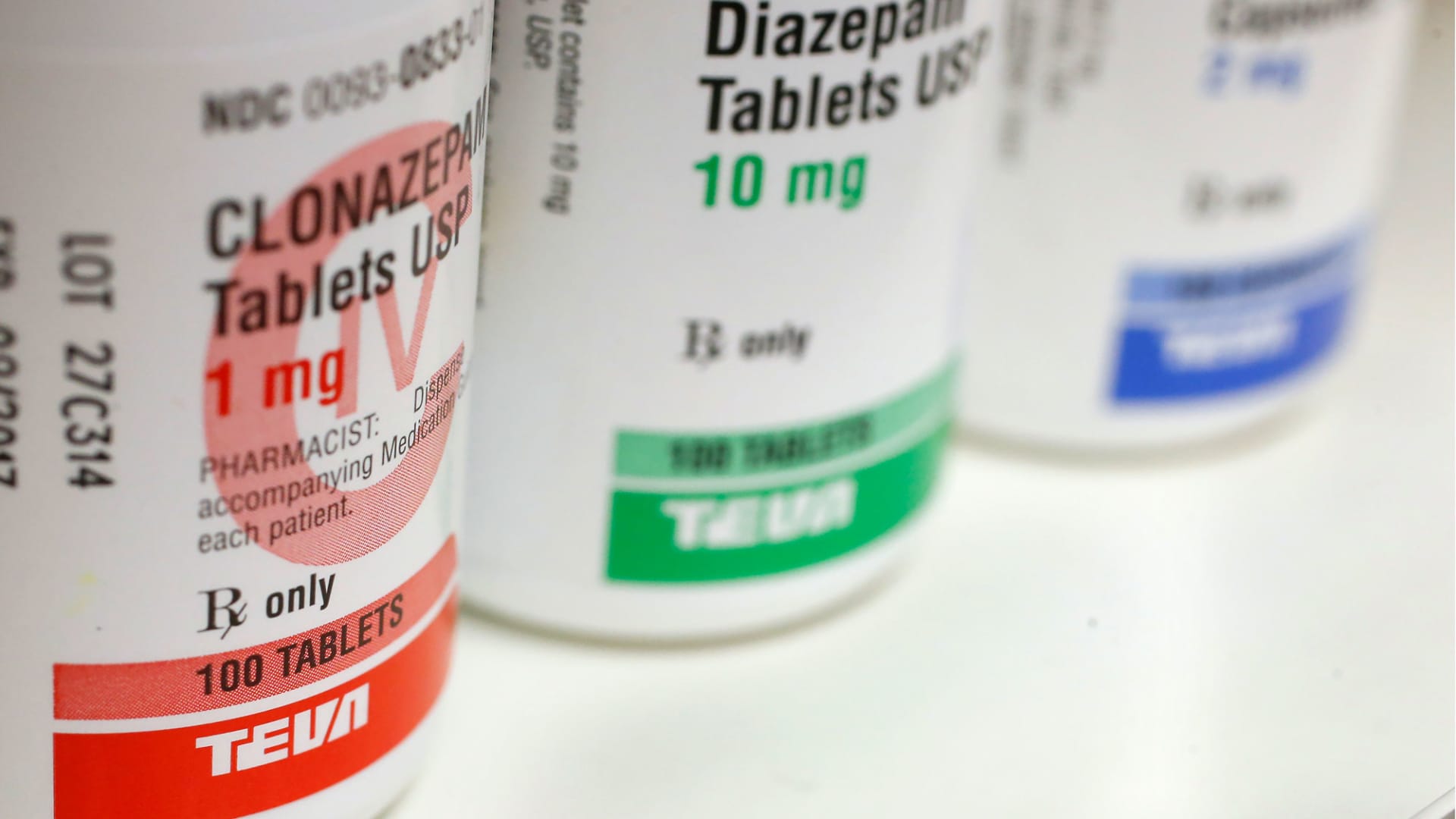

UBS downgrades Teva to sell as CEO exit, ongoing litigation cloud the pharma stock's outlook - CNBC

"Exit" - Google News

https://ift.tt/VtJwL53

https://ift.tt/gNEBJDw

Bagikan Berita Ini

0 Response to "UBS downgrades Teva to sell as CEO exit, ongoing litigation cloud the pharma stock's outlook - CNBC"

Post a Comment