Joe Raedle

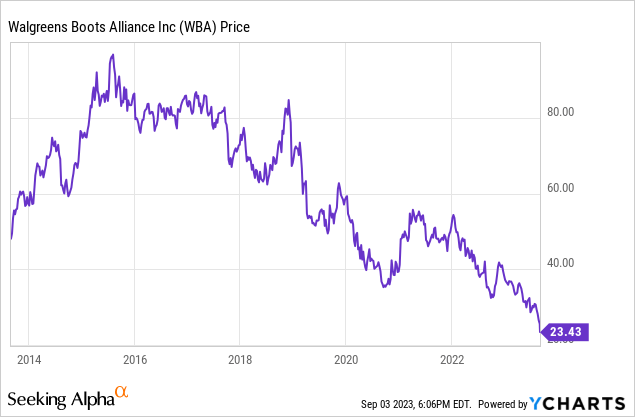

It has been a while since I last wrote about Walgreens (NASDAQ:WBA) back in March 2020 and the stock has been one of the worst performers in my portfolio. Since that article back in the midst of COVID, the stock has decreased around 48% compared to the S&P 500 increase of 77%. This performance is terribly disappointing, but before selling I still need to get a sense of the valuation to see if continuing to be an investor might be a good risk-reward opportunity in this expensive market.

With Walgreens' CEO, Rosalind Brewer, stepping down in recent days, the stock has took another deep plunge. This leaves Walgreen's with a juicy dividend yield of 7.59% and while the TTM EPS is negative, management (soon to be under a new CEO) as of the latest quarter was guiding to 2023 adjusted EPS of $4.03 at the mid-point which implies a forward earnings yield of 17.2% or P/E of 5.8x.

These great yields are opportunistic and there could be real risk from the decline in profitability being permanent due to higher competition and lower generic drug prices. This article will take a look at the health of the company and dividend as well as comparing that forward guidance from management to a longer-term free cash flow analysis. The latest CEO had a some rough years recently with lawsuits and declining profitability. But Walgreen's will continue to go on in my opinion and hopefully a new CEO can reinvigorate the business.

Latest Results and the Negative Share Price

Part of the recent pessimism in Walgreen's stock is that net income has been negative in the TTM period at -$3.3 billion (-$3.84 EPS). These poor results are mainly due to the $6.5 billion pre-tax charge recognized in connection with the opioid litigation settlement frameworks and certain other opioid-related matters in Q1 FY 2023 as well as $783 million non-cash impairment charge related to intangible assets in Boots UK in Q2 FY 2022.

Walgreen's latest Q3 FY 2023 results includes a $532 million after-tax charge for opioid-related claims and lawsuits and after-tax charges of $323 million from impairments related to pharmacy license intangible assets in Boots UK; partially offset by $420 million after-tax gain on sale of Cencora (COR), formerly AmerisourceBergen Corporation shares . In terms of actual day-to-day operations, the retailer had U.S. comparable sales +7.0%, led by Pharmacy +9.8%, with Retail ex. tobacco +0.2%. International constant currency sales +6.9%, led by Boots UK comparable retail sales +13.4%. Adjusted EPS of $1.00 increased +3.6% on a constant currency basis compared to the prior year adjusted EPS of $0.96.

Management updated fiscal year 2023 adjusted EPS guidance to $4.00-$4.05 to reflect consumer and category trends, lower COVID-19 related contribution, and a more cautious macroeconomic forward view. This means they expect core adjusted EPS to be flat to +1% ex. COVID-19 and foreign exchange. Management continues to have confidence in building to sustainable, long-term low-teens adj. EPS growth over time.

Quick Intro to the Company and Risks

Walgreens Boots Alliance was created through the 2014 combination of Walgreens and Alliance Boots, with their heritage dating back over 100 years. Through a portfolio of retail and business brands, including Walgreens, Duane Reade, Boots and Alliance Healthcare, the company has a diverse range of operations spanning the U.S., Europe and Latin America which operate in more than 9 countries. Walgreens has approximately 13,000 retail stores and 325,000 employees.

Walgreens has seen a few tough years as the business makes its way through COVID, the opioid lawsuits, and margin pressure in their core pharmacy business from generics. While the company is working to diversify into physical clinics and care with the acquisitions of Village MD and Shields Health Solutions, they did not go as far as to enter the insurance space as their peer CVS did with their $69 billion acquisition of Aetna. This leaves Walgreens as a more pure-play pharmacy and retailer which has its positives and negatives in the competitive landscape. If investors want to buy a health insurer on the side, they always have the option to invest in that industry separately.

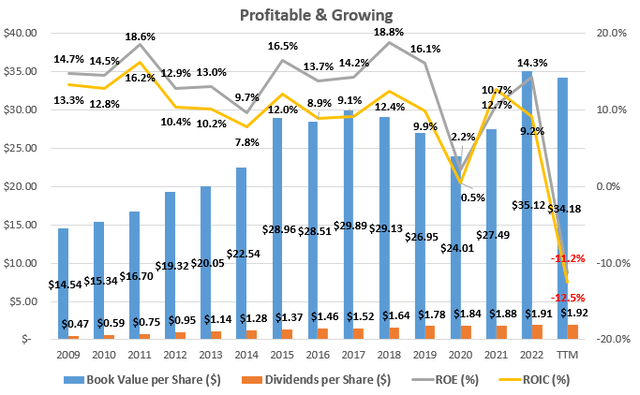

A Profitable and Growing Business

Walgreens' strong business portfolio and efficient operations have allowed it to achieve an average return on equity (ROE) and return on invested capital (ROIC) of 11.9% and 8.9% respectively over the past decade. This level of profitability is slightly below my rule of thumb of 15% ROE and 9% ROIC but if we exclude the latest TTM when the largest part of the opioid settlements ($6.5 billion pre-tax charge) took place, the ROE and ROIC jump up to 13.5% and 10.4% respectively. These long-term figures allow me to be confident that, in my opinion, the company is able to maintain and continue to increase its intrinsic value in the future. Hopefully there are no more drug distribution lawsuits lurking in the background.

Historical Profitability at Walgreens (compiled by author from company financials)

On the growth side, book value per share has grown from $14.54 in 2008 to $34.2 in the latest quarter. When combined with the dividends paid out from equity this growth in book value has averaged 12.8% annually which further supports the average ROE calculation. Keep in mind this growth in book value does take into account the recent impairments of the U.K. Boots business as well as the opioid settlements.

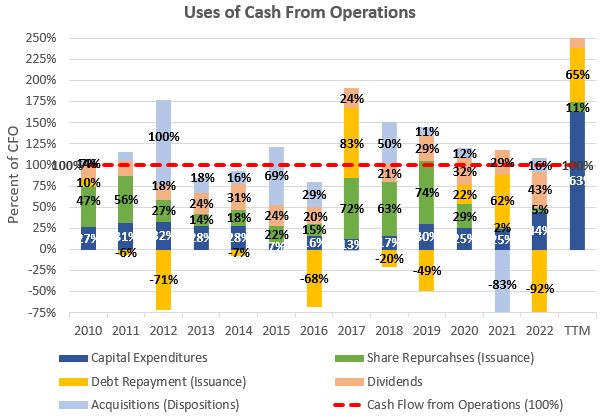

How is the Cash Flow?

Strong businesses with wide moats such as Walgreens' are able to generate cash beyond what is needed to fund sustainable operations. As can be seen in the graph below, capital expenditures and acquisitions have averaged only 45% of cash flow from operations (CFO) over the past decade.

Cash Flow Analysis of Walgreens (compiled by author from company financials)

With capital expenditures and acquisitions only taking up on average 45% of cash flow from operations over the past decade, this leaves approximately 55% to be returned to investors in the form of dividends and share repurchases. With average cash flow from operations of $5.0 billion over the past five years, this 55% would imply free cash flow to shareholders of $2.8 billion for an impressive 13.8% free cash flow yield at the current $20.2 billion market capitalization.

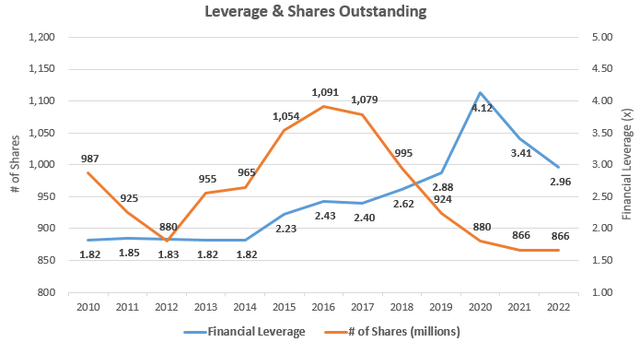

Interest Coverage & Debt

Over the past decade, finance leverage (assets/equity) at the company has grown steadily from 1.82 in 2010 to 2.96x, as can be seen in the chart below. Notable amounts of debt were issued in 2012, 2016, and 2019 to support acquisitions as can be seen in the cash flow graph earlier, and the new accounting standard FASB Leases 842 which added operating lease assets and obligations to the balance sheet.

Capital Structure at Walgreens (compiled by author from company financials)

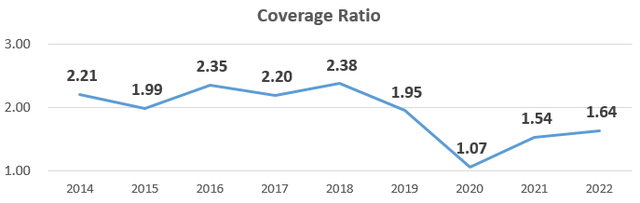

Looking at debt and interest only tells a small part of the story for retailers, as many in the industry choose to lease store space rather than own it. Retailers can be highly leveraged both financially and operationally and Walgreens is no exception. Walgreens had a whopping had $4.1 billion of lease expenses in FY 2022. With large leases being part of the business, it is crucial to look at coverage ratio of both lease and interest payments as they compare to operating income before lease payments. Looking at such a coverage ratio of lease and interest payments for Walgreens, it came to only 1.13x in FY 2022. If we adjust for the $2.3 billion of irregular cash flow (impairments, lawsuits, etc.) the interest coverage remains 1.64x still as can be seen in the table and graph below

Interest Coverage with Leases at Walgreens (compiled by author from company financials)

Takeaway for Investors

Walgreens is a great business with trusted and convenient pharmacies across 9 countries. The company has had a few rough years but the economics look good long-term and the health of the business seems intact after adjusting for what are hopefully irregular items. Even with the profitability weakening, the potential yields such as the forward earnings yield of 17.2% (P/E of 5.8x) are opportunistic and could be worth the risk. I will probably be adding to my Walgreen's position after the CEO's exit and latest plunge.

"Exit" - Google News

September 05, 2023 at 11:47PM

https://ift.tt/jWh8VyN

Walgreens On Clearance Sale After CEO Exit (NASDAQ:WBA) - Seeking Alpha

"Exit" - Google News

https://ift.tt/lYxjK47

https://ift.tt/BcQ7eHb

Bagikan Berita Ini

0 Response to "Walgreens On Clearance Sale After CEO Exit (NASDAQ:WBA) - Seeking Alpha"

Post a Comment