Sydney-based Origin Energy Ltd. plans to divest its interest in Australia’s Beetaloo Basin and end its involvement in a joint venture (JV) to develop unconventional natural gas resources in the play as it continues to focus on energy transition initiatives.

Origin – which also has power generation assets and utility businesses in Australia, Papua New Guinea and the South Pacific – disclosed Monday it would sell its 77.5% stake in the Beetaloo to an affiliate of Tamboran Resources Ltd. Tamboran’s largest shareholder is former Parsley Energy Inc. CEO Bryan Sheffield, the son of Pioneer Natural Resources Inc. CEO Scott Sheffield.

Tamboran has agreed to pay $60 million for the Beetaloo Basin assets located in the Northern Territory. It would also pay a 5.5% royalty on the future wellhead revenues produced over the life of the field.

Origin also said it would begin a strategic review of its remaining exploration permits in Australia, “with a view to exiting those permits over time.” The review would exclude its interests in Australia Pacific LNG (APLNG), which is fed by coal seam gas from the Bowen and Surat basins in Queensland.

“The decision to divest our interest in the Beetaloo and exit other upstream exploration permits over time, will enable greater flexibility to allocate capital towards our strategic priorities to grow cleaner energy and customers solutions, and deliver reliable energy through the transition,” said Origin CEO Frank Calabria.

He said Origin still believes natural gas will continue to play an important role in the region’s energy mix, but cited the uncertainty and high costs of exploration and appraisal for the company’s decision to exit the shale play.

Origin holds a 27.5% stake in APLNG, a 10 million metric tons/year export terminal in Queensland. The company sold a 10% stake in the facility, considered the largest of its kind on Australia’s eastern seaboard, to majority owner ConocoPhillips late last year. Origin executives said at the time that the sale would free up funds to invest in the transition to low-carbon energy.

Origin has explored the Betaloo for eight years along with Falcon Oil & Gas Ltd., which owns a 22.5% stake in the JV. Tamboran would become operator of the project if it wins regulatory approval and the deal closes.

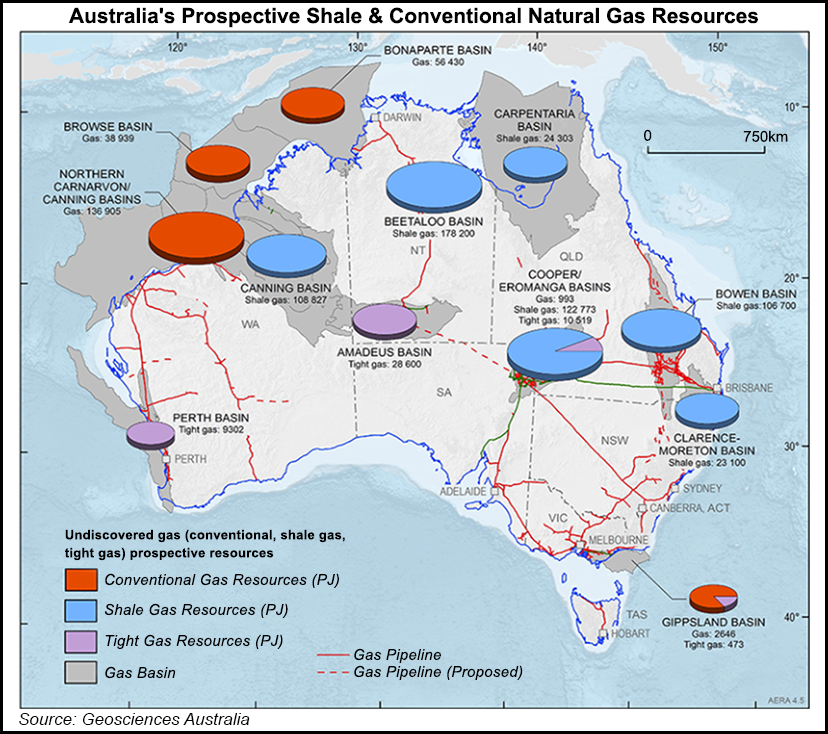

The largely untapped basin contains estimated undiscovered, technically recoverable mean resources of 429 million bbl of continuous oil and 8 Tcf of continuous gas, according to a 2018 assessment by the U.S. Geological Survey. The Beetaloo is located in a vast, remote area the size of Texas that would also need infrastructure to move supplies to domestic markets and export facilities.

Origin also signed a gas sales agreement with Tamboran to secure supplies from the Beetaloo if development ultimately occurs in the basin.

Australia’s Department of Industry, Science and Resources said production needs to start in the play by 2025 to meet the expected window of maximum gas demand and potential declines in production in southern states. The department expects exploration to be finalized by 2023 and followed by four years of appraisal.

The government is aiming to accelerate development and bring forward a final investment decision on the field by 2025 or earlier.

"Exit" - Google News

September 21, 2022 at 01:51AM

https://ift.tt/clMa3VQ

Origin Planning Exit From Most Upstream Assets, but Keeping Stake in Australia Pacific LNG - Natural Gas Intelligence

"Exit" - Google News

https://ift.tt/Jj0y3oH

https://ift.tt/9PFmRiz

Bagikan Berita Ini

0 Response to "Origin Planning Exit From Most Upstream Assets, but Keeping Stake in Australia Pacific LNG - Natural Gas Intelligence"

Post a Comment